2023 Tax Credit Updates When it comes to managing your taxes, tax credits can be a powerful tool in reducing your overall tax burden. By qualifying for one or more tax credits, you can lower the amount of taxes you owe or even receive a refund. It’s important to note that in order to claim…

The IRS conducts examinations of certain tax returns in order to ascertain compliance with tax laws. Usually, only a small percentage of tax returns are audited. In 2022, the agency audited 3.8 out of every 1,000 income returns, which is a rate of 0.38%. Even though most taxpayers are unlikely to get audited, it helps…

When it comes to taxes, one thing is certain: income matters. From the money you earn through hard work to the unexpected sources that come your way, understanding what income is taxable is essential. Whether it’s your wages, salaries, royalties, commissions, rent, fees, or tips, these familiar sources of income all fall under the watchful…

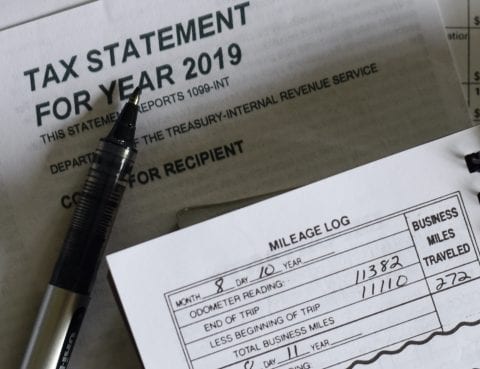

Every year, when taxpayers get ready to file their taxes, one of the first things they should do is understand all the ways they can lower their tax bills, such as tax deductions and tax credits. There are widely known tax deductions, such as business travel and vehicle expenses, as well as lesser-known deductions you…

Did you know the IRS has the authority to seize Social Security checks to satisfy outstanding tax liabilities? If you’re facing back tax debt, protecting your Social Security benefits from IRS seizure is a crucial step in tax debt resolution. But don’t panic – the IRS follows a specific process before taking action. Understanding the…

Introduction to IRS Collection Standards Updated information to reflect 2023 IRS standards. Did you know the IRS utilizes Collection Financial Standards to determine the financial capability of a taxpayer? These standards help determine the suitable collection method to recover the tax debt. The Collection Financial Standards are applied to various collection methods, including Installment Agreements,…

Now that tax season has ended, many hard-working Americans may be overwhelmed by a hefty tax bill. Fortunately, the IRS offers an Offer in Compromise (OIC) option, which allows taxpayers to settle their tax debts for less than the total amount owed. However, qualifying for an OIC is not always easy, and it’s essential to…

With the lingering impacts of the coronavirus pandemic, it’s essential to stay informed about financial benefits that can alleviate some of the burdens during these challenging times. The changing tax landscape requires a fresh approach to tax planning for 2023. Our updated blog post discusses three key tax planning tips to help you navigate the…

Tax season can be stressful for anyone, but it can be particularly challenging for 1099 workers and taxpayers over the age of 30 with bills, kids, and other responsibilities. Unfortunately, missing the deadline to file your 2022 tax return can have dire consequences, including IRS penalties and interest, back taxes, and back tax debt. In…

What are the Consequences of Back Tax Debt? When it comes to tax debt, procrastination can have serious consequences. Unfortunately, many people fail to take the time to do their taxes or, worse, let them lapse and end up dealing with the repercussions, which could involve legal proceedings. Understanding the risks involved in not addressing…