The IRS has been shouting hoarse about the lack of funding for years. Due to cuts in funding, the agency had to shrink many of its services. But there’s another big loss happening: a research study from Indiana University Kelley School of Business has revealed that budget cuts at the IRS have lead to the loss of billions…

IRS Releases List of the “Dirty Dozen” Tax Scams to Avoid The IRS has released a list named the “Dirty Dozen”, comprising of some of the top tax scams that affect taxpayers. PBS reports on this story and also provides some scam red flags to watch out for. If you have any doubt of the…

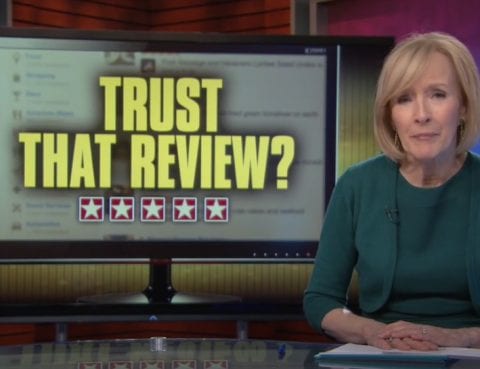

Spotting the Fakes Among the Five Star Reviews PBS: How many five-star reviews are fake? More than you might think. PBS News sits down with a paid fake reviewer to discuss the ins and outs of this troublesome trend, and what some businesses are working to do to prevent such practices. Fill out the form…

Beware of IRS Phone Scams NJTV News discusses phone scammers. One reporter receives an IRS phone scam call and shows how these scammers work to deceive American taxpayers to give them money to pay off a fake tax debt. NJTV also speaks with an IRS spokesman about their experience. Fill out the form for a…

A Tax Lien Withdrawal is technically considered a third tier of the Fresh Start Program. While you can pay off your tax debt through full repayment to have your tax lien removed, the Fresh Start Program offers a second way for you to have your tax lien removed. If you request to have your tax…

This page has been updated for 2022 tax return guidelines. Did you fail to file your tax return this year? You’re not alone. Over 175 million individuals did not file a tax return this year alone. While many of these individuals fall under an exemption, many more simply failed to file for other reasons. Requirements to a…

Those who owe a tax debt to the IRS will typically also have a state tax debt. There are many ways to gain a tax debt with a state; however, the most common way it occurs is when an individual works and lives in separate states. Filing your tax returns with an inexperienced accountant or…

Whom do you contact for tax assistance if you cannot afford a professional tax service? You can read through the information on the IRS website, which might not tell you exactly what to do. Or, you can call the IRS, which most likely doesn’t get you to talk to an agent. Essentially, you are on your…

This program provides taxpayers a form of relief by entering into a repayment program that can last up to six years. Taxpayers make monthly payments towards their tax liability that is based on their ability to pay, current income, and liquid assets. At the end of the approved time period, the tax debt will be…

The Offer in Compromise program is the more frequently known debt relief program. You may have heard many advertisements with the catchphrase, Pennies on the Dollar. With an Offer in Compromise, a taxpayer can present the IRS an offer of how much they are able to pay off their tax debt. If the IRS agrees,…