Every year, when taxpayers get ready to file their taxes, one of the first things they should do is understand all the ways they can lower their tax bills, such as tax deductions and tax credits.

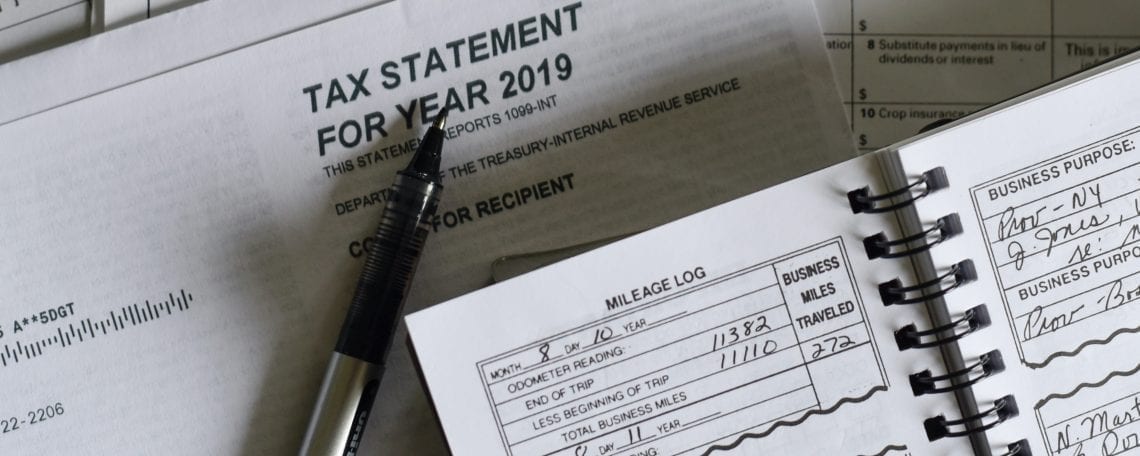

There are widely known tax deductions, such as business travel and vehicle expenses, as well as lesser-known deductions you can apply to your tax return. Understanding and effectively utilizing these deductions can significantly decrease your tax liability.

Tax laws often change, so staying current on changing guidelines is crucial. We understand that jargon can get confusing. At Justice Tax, we aim to be your go-to resource for tax information by providing you with easy-to-understand guidance and timely insights as often as the guidelines are updated.

This guide will walk you through the latest tax deduction guidelines, providing you with the knowledge you need to navigate your taxes efficiently and some deductions you may not be aware of this year.

The Power of Tax Deductions

Tax deductions are your secret weapon to off-setting or reducing what you owe each year. They differ from tax credits, which directly decrease the amount of taxes you owe to the government.

In the world of tax deductions, you have two primary choices: the standard deduction or itemized deductions. The choice between the two depends on which method will provide you with the largest deduction.

What is the Difference Between Tax Deductions and Tax Credits?

- Credits applicable to you reduce the amount of tax you owe.

- Deductions can reduce the amount of your income before you calculate the tax you owe.

The 2023 Standard Deduction

The standard deduction is a fixed amount that taxpayers can subtract from their income. This amount varies based on your filing status. According to the IRS, the standard deductions for 2023 are as follows:

Married Filing Jointly: $25,900

Head of Household: $19,400

Single: $12,950

Married Filing Separately: $12,950

If itemized deductions total more than standard deductions, itemizing may be beneficial. However, if not, you’ll likely save time and money by taking the standard deduction.

2023 Itemized Deductions

Itemized deductions allow taxpayers to deduct a variety of expenses from their taxable income. Here are the primary categories of itemized deductions for 2023:

- Deductible nonbusiness taxes

- Personal Property tax

- Real estate tax

- Sales tax

- Charitable contributions

- Gambling loss

- Miscellaneous expenses

- Interest expense

- Home mortgage interest

- Moving expenses

Above-the-Line Deductions for 2023

In addition to standard and itemized deductions, there are also above-the-line deductions. These are subtracted from your gross income to calculate your AGI and are available regardless of whether you itemize or take the standard deduction. Some of the most common above-the-line deductions for 2023 include:

- Traditional IRA deduction

- Health Savings Account – HSA/FSA deduction

- Dependent care FSA contributions

- Student loan interest deduction

- Teacher classroom expenses

- Self-employed tax deductions

- Alimony deduction

- Moving expense deduction (for armed forces)

Maximizing Your Savings: Lesser-Known Tax Deductions and Credits for 2022-2023

There are numerous deductions and credits you can take advantage of. Let’s explore.

Charitable Contribution Deduction: For tax years 2020 and 2021, taxpayers who claimed the standard deduction could also deduct up to $300 of their charitable donations in 2021 (up to $600 for joint filers). In 2022, if you want to deduct more of your contributions, the only option is to take the official deduction for charitable contributions, which most people don’t qualify for because it’s an itemized deduction 1.

Educator Expenses: In 2022, educators can also deduct unreimbursed expenses for protective items to stop the spread of COVID-19 1.

Half of the Self-Employment Tax: The self-employment tax was 15.3% for 2022, and anyone who paid that full tax can then deduct half of it from their 2022 taxes.

Child and Dependent Care Credit: For 2022, if you paid a provider to care for your children under age 13 (or a disabled dependent of any age), you could be eligible for a non-refundable tax credit up to 35% or $3,000 of qualifying expenses for one child. The credit can be up to $6,000 for two or more qualifying children.

Dependent Tax Credit: There is a $500 tax credit for claiming a dependent on your return when that dependent doesn’t qualify for the child tax credit. So, your children over 17 years of age can save you some money at tax time—even if they’re in college. You can also claim the dependent tax credit for older relatives you care for at home.

Electric Vehicle Tax Credit: The nonrefundable EV tax credit ranges from $2,500 to $7500 for tax year 2022; eligibility depends on the vehicle’s weight, the manufacturer, and whether you own the car. For tax year 2023 (taxes filed in 2024), the credit is greatly expanded and also includes used vehicles 3.Please note that tax laws are complex and change frequently. It’s always a good idea to consult one of our tax professionals to understand which deductions and credits apply to your situation.

The Inflation Reduction Act of 2022

Another important change for tax season this year and moving forward is the Inflation Reduction Act of 2022.

According to Wikipedia, The Inflation Reduction Act of 2022 (IRA) is a landmark United States federal law that aims to curb inflation by possibly reducing the federal government budget deficit, lowering prescription drug prices, and investing in domestic energy production while promoting clean energy.

Per the IRS, The Inflation Reduction Act covers new and reinstated tax laws that will affect individuals and businesses, including a number of credits and deductions.

Planning for Tax Season

Preparing for tax season, you should consider whether the standard deduction or itemizing will benefit you most. Keeping detailed records and receipts is worthwhile if you anticipate that many of your expenses will qualify for itemized deductions.

Remember, tax planning is not a one-size-fits-all process. Your unique circumstances will determine the best approach for you.

Let Justice Tax Help You Navigate Your Taxes

At Justice Tax, we understand that navigating tax deductions can be complex. Our team of tax professionals is here to guide you through the the tax resolution process, ensuring you receive the justice you deserve.

Justice Tax, LLC has been on a mission since 2000 to assist taxpayers with their IRS and state tax needs, delivering unparalleled standards of client satisfaction in our communication and services. We believe in treating our clients with empathy and are driven by our desire to help them achieve the best possible outcomes. Whether you’re dealing with tax preparation, back taxes, or seeking a CPA for tax resolution, we’re here to help.

Don’t let tax worries keep you up at night. Contact us today for a free consultation and let Justice Tax bring you the peace of mind you deserve.

Fill out the form for a free and confidential consultation.