An audit is never pleasant, but you can make it simpler and smoother by preparing for it. Essentially, audits are conducted to ensure compliance and in no way indicate that you did something illegal. The IRS doesn’t come to you with proof of any ill-doing. They may have seen a discrepancy in your reporting and want you to review and correct it. If you have been compliant, there is nothing to worry about; and if you haven’t been compliant, there are options available to you.

What Triggers an IRS Audit

Though the IRS also randomly selects returns for audit, there are certain other criteria that triggers audits. These include:

- Bloated deductions or business expenses

- Sudden hike in income

- Unusually consistent losses

- Too many cash transactions

- Non-filing of a return(s)

- Underreported income

- Errors in claiming deductions/credits

The IRS may also pick returns for audit that are financially connected with an individual or a business that they are currently auditing.

Preparing for an Audit

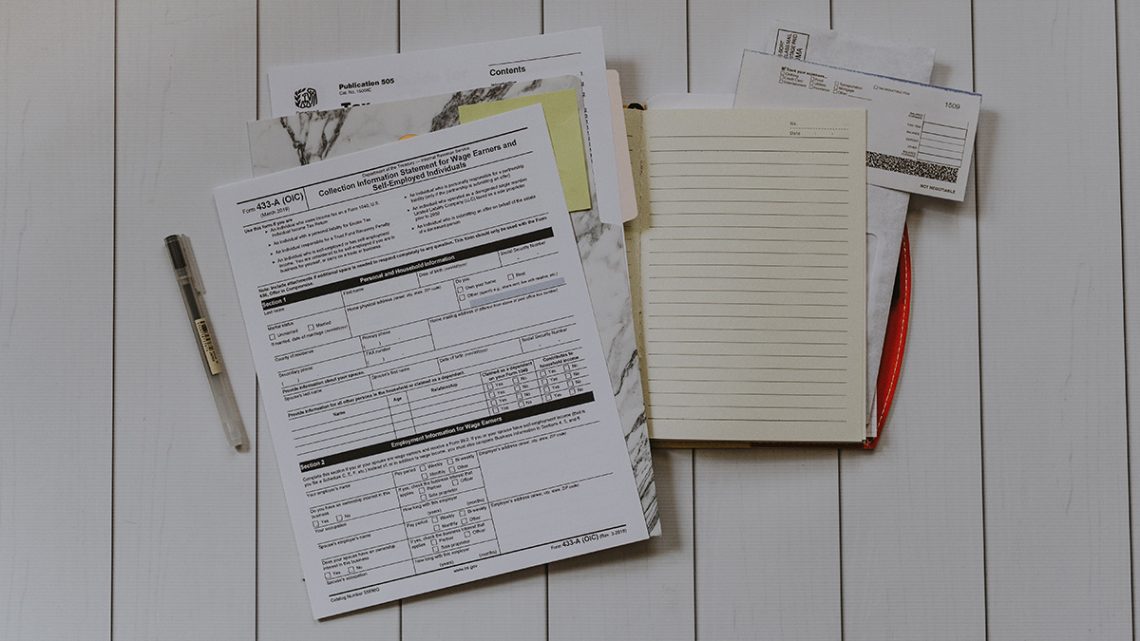

The IRS informs taxpayers of an audit through postal mail. The IRS audit letter contains details of why the return has been chosen for an audit and how the taxpayer is expected to respond. The IRS may conduct the audit by mail or in-person. An in-person audit may be conducted at the taxpayer’s residence or office, IRS office or the accountant’s office.

Review the audit letter carefully – Since the IRS audit letter is your first point of contact with the IRS, read it carefully to see what the IRS found to be objectionable and what they are requesting you to do. Carefully study your options if provided in the letter. In most cases, an audit letter will specifically point out the reason for the audit.

File unfiled returns – The first thing to look at are your previous year’s tax returns. If you haven’t filed a past tax return, you will need to file it right away because that will be the first request the IRS will make of you. Usually, the IRS will only look at the past three year’s tax returns and records. However, there is no rule restricting them to three years and they may go back to up to 6 years if they deem fit.

Gather financial and tax receipts – Gather receipts of expenses you have claimed on your returns. A written proof of claims made on your return will be in your favour, so collect all receipts, bills, income certificates and forms, and any supporting documents that will prove your point.

Anticipate the questions – In case of a mail audit, a taxpayer has sufficient time to think their response before replying. However, an in-person audit interview requires quick responses. If preparing to be interviewed by an IRS agent, prepare a list of the most plausible questions that the agent may ask. Since you are already aware of why you are being audited (by reviewing the audit letter), you can prepare your responses and gather relevant documents to back your claims. This will help in providing relevant and targeted information quickly to the agent, making the entire process quicker and smoother.

Hire a tax attorney – An audit can be as short and sweet as sending a few documents to the IRS through mail, or it can involve extensive examinations that go on for weeks. If you feel you can face difficulty in handling the audit on your own, consider hiring a tax attorney, a CPA or an enrolled agent to help you with it. These tax specialists are licensed to represent taxpayers before the IRS, and ease the burden of preparing and responding to an audit.

Conclusion

An audit might sound frightening, but it doesn’t need to be. Excellent tax records, precise communication with the IRS and meticulous preparation can go a long way in making an audit smooth and stress-free. Also, you always have the option to hire a tax specialist if you find it difficult to handle it alone or would prefer to have an expert handle it for you.